The financial world has experienced a seismic shift in recent years, with Bitcoin leading the charge. Once considered an outlier, Bitcoin is now being embraced by mainstream financial institutions and corporations alike. This dramatic adoption signals a paradigm-shifting change in the perception of copyright, moving it from the fringes to the center stage of the global economy.

Corporations across various sectors are incorporating Bitcoin into their strategies, recognizing its potential as a hedge against inflation.

From financial behemoths like BlackRock to tech giants like Tesla, the trend is undeniable. This global surge is transforming Wall Street and disrupting the traditional financial landscape.

Unlocking Value: How Corporations are Leveraging Bitcoin

Corporations are increasingly adopting Bitcoin as a viable tool, harnessing its potential to revolutionize traditional business models. From streamliningtransactions to diversifying inflation, businesses are leveraging the unique characteristics of Bitcoin to improve their performance. {Furthermore|{Additionally|Moreover, Bitcoin's growing legitimacy in the global market presents new opportunities for corporations to engage with a wider customer base and tap into emerging industries.

Transcending Speculation: Bitcoin as a Strategic Asset for Enterprises

In today's volatile economic landscape, enterprises are seeking alternative investment strategies that can offset risk and produce long-term returns. Bitcoin, the pioneering copyright, has emerged as a promising asset class that goes beyond mere speculation. Its autonomous nature, limited supply, and growing acceptance have placed it as a strategic opportunity for forward-thinking businesses.

- Additionally, Bitcoin's transparency provides enterprises with enhanced accountability. This can be especially valuable in industries where regulation is paramount.

- Additionally, Bitcoin's worldwide accessibility allows enterprises to leverage new markets and expand their customer base.

As a result, integrating Bitcoin as a strategic asset can offer enterprises a unique opportunity in the evolving global economy.

Navigating the Bitcoin Landscape: A Guide for Corporate Investors

Venturing into the realm of cryptocurrencies can be a daunting task, particularly for established corporate entities. Decentralized assets like Bitcoin present both tremendous opportunities and inherent risks, requiring meticulous due diligence and a well-defined plan.

A key factor for corporate investors is understanding the dynamics of the Bitcoin market. Historically, its price has been known to swing wildly, which can present challenges for traditional finance-minded businesses.

Before embarking into Bitcoin investments, corporations should undertake a thorough analysis of their financial capacity. This entails assessing the potential impact of price volatility on their overall holdings and daily activities.

Furthermore, corporations must implement secure systems for storing Bitcoin. Given the decentralized nature of cryptocurrencies, more info traditional measures may not be adequate.

A reputable blockchain platform is crucial to reduce the risk of theft and ensure the integrity of digital assets.

Navigating the Bitcoin landscape effectively requires a blend of market knowledge. Corporations should collaborate with experienced professionals in the copyright space to gain insights.

The Future of Finance: Bitcoin Integration in Corporate Strategies

As the financial landscape evolves at an unprecedented pace, corporations are scrutinizing innovative technologies to optimize their processes. Among these advancements, Bitcoin stands out as a disruptive force with the potential to transform traditional models within finance. Forward-thinking businesses are incorporating Bitcoin into their plans, recognizing its value in areas such as cross-border payments, security. This integration offers a unique opportunity for corporations to enhance their financial operations and capitalize the benefits of this evolving digital asset.

- Moreover, Bitcoin's decentralized nature can reduce reliance on traditional intermediaries, possibly leading to financial efficiencies.

- However, the integration of Bitcoin into corporate strategies also offers roadblocks that corporations must overcome.

Regulatory uncertainties surrounding Bitcoin remain a key concern for many companies.

Institutional Safeguarding: Safeguarding Bitcoin Assets

In the evolving landscape of copyright, securing cryptographic assets has become paramount. Corporate custody solutions are gaining traction as a means to safeguard Bitcoin investments for businesses and firms. These specialized services offer advanced security measures, including cold storage solutions, to mitigate the risks associated with cyberattacks. By entrusting their digital assets to reputable custodians, corporations can strengthen their overall risk management strategy and promote confidence in the security of their holdings.

Furthermore, corporate custody providers often offer a suite of value-added services, such as accounting solutions, to streamline the management of Bitcoin assets. As the digital asset space continues to mature, corporate custody is poised to play an critical role in shaping a more robust financial future.

Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Justine Bateman Then & Now!

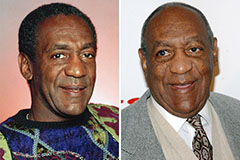

Justine Bateman Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!